The answer is: Yes, sometimes.

If your retirement income consists mainly of Social Security benefits, you likely won’t owe taxes on those benefits. However, if you have substantial savings in tax-deferred accounts like 401(k)s or traditional IRAs, you may be surprised to learn that up to 85% of your Social Security benefits could become taxable.

AGI (Adjusted Gross Income) versus Combined Income.

You may already know about Adjusted Gross Income (AGI), which is your gross income from sources such as wages, self-employment earnings, interest, dividends, required minimum distributions (RMDs), and other taxable income, minus allowable deductions like student loan interest or charitable contributions.

Unearned taxable income can include things like canceled debts, alimony, unemployment benefits, lottery winnings, and gains from the sale of appreciated assets.

Combined Income is a formula used after you file for your Social Security benefits.

Whether or not your Social Security benefits are taxable depends on your combined income (sometimes called provisional income) each year, which is defined as your adjusted gross income (AGI) plus your tax-exempt interest income (like municipal bonds) plus one-half of your Social Security benefits.

Whether or not your Social Security benefits are taxable depends on your combined income (sometimes called provisional income) each year, which is defined as your adjusted gross income (AGI) plus your tax-exempt interest income (like municipal bonds) plus one-half of your Social Security benefits.

If your combined income exceeds the limit, then up to 85% of your benefit may be taxable. But in accordance with Internal Revenue Service (IRS) rules, you won’t pay federal income tax on any more than 85% of your Social Security benefits.

What are the combined income limits?

Social Security benefits may be taxable if your overall combined income exceeds certain thresholds, which vary depending on your tax filing status.

If you file a federal tax return as an “individual” and your combined income is below $25,000 in 2025, your Social Security won’t be taxed.

For individual filers, if your combined income is between $25,000 and $34,000, you may owe income tax on up to 50% of your Social Security benefits. If your income exceeds $34,000, up to 85% of your benefits may be taxable.

If you file a “joint” return, and you and your spouse have a combined income that is below $32,000 in 2025, your Social Security won’t be taxed.

For couples filing jointly, similar graduated thresholds apply, with those earning between $32,000 to $44,000 owing tax on 50% of their benefits. If their income exceeds $44,000, up to 85% of benefits may be taxable.

These thresholds are periodically adjusted for inflation, so it’s important to check current IRS guidelines or consult a tax professional to determine your specific limits.

RMDs (Required Minimum Distributions) can be an unwelcome surprise.

Starting at age 73 (age 75 in 2033), you are required to start taking money out of your tax-deferred accounts every year, whether you need the income or not. These accounts include:

- Traditional IRAs

- SEP IRAs

- SIMPLE IRAs

- Rollover IRAs

- Traditional non-Roth 401(k) and 403(b) plans

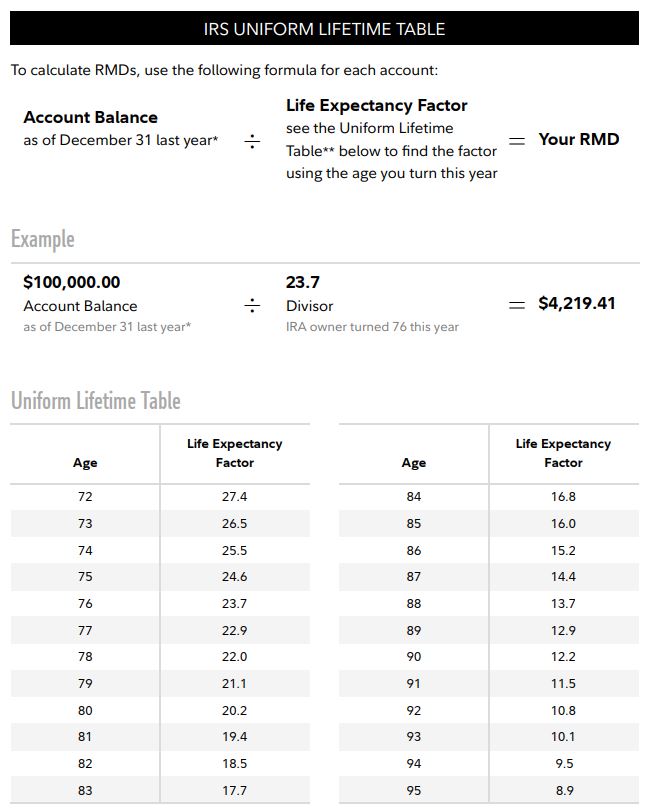

The IRS provides specific tables, such as the Uniform Lifetime Table, to calculate your annual RMD amount based on your account balance and life expectancy. It is crucial to withdraw the required amount by December 31 each year to avoid penalties. Failure to do so can result in a penalty of up to 10% of the amount that should have been withdrawn, and there is no grace period past the deadline.

The uniform lifetime table goes up to age 120; learn more here.

Learn more about life expectancy tables here.

Don’t let taxes in retirement take you by surprise. We work in conjunction with your CPA or tax professional to help you consider taxes and how to minimize them as part of your overall retirement plan. Call us.

This material is not intended to be used, nor can it be used by any taxpayer, for the purpose of avoiding U.S. federal, state or local taxes or penalties. The information in this article is provided for general education purposes only. Do not rely on this information for tax advice. Check with your CPA, attorney or qualified tax advisor for precise information about your specific situation.

Sources: